Fintech in Latin America

Fintech in Latin America

Investors and economists have projected the rise of fintech in Latin America for some time. In 2017, Latin America was recognized as a region badly in need of banking services and payment solutions.

Since then, fintech in LatAm has grown considerably. So far, 2021’s investment in Latin American financial services already exceeds 2020 in entirety.

More specifically, payment and remittances account for 26% of all fintechs in Latin America (2020). Lending comprises another 21% of LatAm fintech focus.

Latin America is hugely underbanked, creating barriers (and opportunity) regarding e-commerce and remittances (the sending and receiving of funds). Furthermore, regulations aligned with traditional methods of banking makes it difficult for entrepreneurs and small businesses to secure funding.

This article explores individual brands and trends related to the rise of fintech in Latin America.

Top Fintech Companies in Latin America

A few short years ago, fintech startups in LatAm attracted $235 million in VC money. In 2019, the number grew to $1.7 billion. Recently, you can’t browse major news sites without reading about investment in Latin American fintech.

Nubank

Nubank is headquartered in Brazil with an office in Mexico. It managed to raise $950 million in just three years. US venture firm, QED Investors, was first reluctant to invest in LatAm; Nubank served as a test.

Since, QED has dedicated a fund toward further investment in Latin America, doubling its previous efforts. Nubank first took advantage of Brazil’s financial landscape, one similar to many found throughout LatAm countries.

In Brazil, just five banks accounted for over 80% of Brazil’s assets, a third of the population was unbanked, and annual credit card rates were running up to 300%. Furthermore, bank branches existed in only 60% of Brazilian cities.

Nubank estimates it has saved customers over $2 billion in fees. Nubank has a good thing going in Latin America and entertains going public on the New York Stock Exchange.

Credijusto

Credijusto started in 2015 and has attracted over $400 million in funding. A great demand for commerce between the US and Latin America inspires Credijusto to help finance and facilitate. It’s planning a near-future acquisition of a North American bank brand .

The recent success in becoming Mexico’s first neobank is a testament to Latin America’s fintech startup landscape. For, it allows a startup with less than 300 employees to get in position to make such a historic impact.

Novo

Fintech continues to secure more venture capital as Novo, helping SMBs conduct digital banking, received over $40 million. More than 100,000 businesses have opened Novo accounts since 2018.

Novo celebrates its quick, easy, and reliable platform that integrates with other business tools such as Stripe, Shopify, and Square. It especially attracted investors by managing to triple its small business customer base since the beginning of 2021..

Novo moved its headquarters from NYC to Miami after experiencing huge success during the pandemic. The fintech brand is now closer to Latin America, a region with increased interest in fintech services and hosting many of its own fintech startups.

Clip

Not to be up-staged by other Latin American fintechs, Clip recently raised $250 million, the largest ever for a payments firm in Mexico, making it valued at $2 billion.

Clip makes convenience and customer service a prime focal point. As similar services emerge throughout Latin America, brand loyalty will become crucial. Clip recognizes its proprietary tech platform as a main attraction for small businesses that desire multiple e-commerce and financial options.

Neon

Neon secured $300 million in September and targets small businesses and entrepreneurs. Traditionally, these customers are often overlooked by banks due to high interest rates.

Read more about Fintech in Mexico

Fintech Investment in Latin America

Some think Latin America’s fintech boom will be accelerated as compared to the US, with advancements happening in months rather than years.

More than $7 billion has been invested toward Latin American financial services companies since 2016. As of June, 2021 investment totals already mirror all of 2020’s.

The rapid ability to raise capital attracts investors and entrepreneurs. One investment firm, Clocktower, estimated it would take months to raise $25 million. It took just weeks, with Clocktower quickly committing to eight investments with four pending.

As with Brazil, few banks control a majority of the market share in many regions. The lack of competition causes banks to focus on building relationships with more affluent customers. This creates an opportunity to service the majority of Latin Americans who feel underserved and have limited banking options.

For example, it’s estimated that Mexico hosts 42 million people who do not have bank accounts. Moreover, many report being “underbanked,” having limited abilities to seek loans or send/receive money without adopting high fees. For small businesses, getting a loan means high service costs.

Fintech startups offer lower costs, better service, and more options. Options that many US citizens and business owners take for granted have long been nonexistent for many Latin Americans.

Read more about Investing in Latin America

Top Fintech Trends in Latin America

Neobanks

A neobank offers similar services to traditional banks yet all transactions are digital, absent of physical store locations. Credijusto is the first fintech to purchase a bank in Mexico, becoming the country’s first neobank.

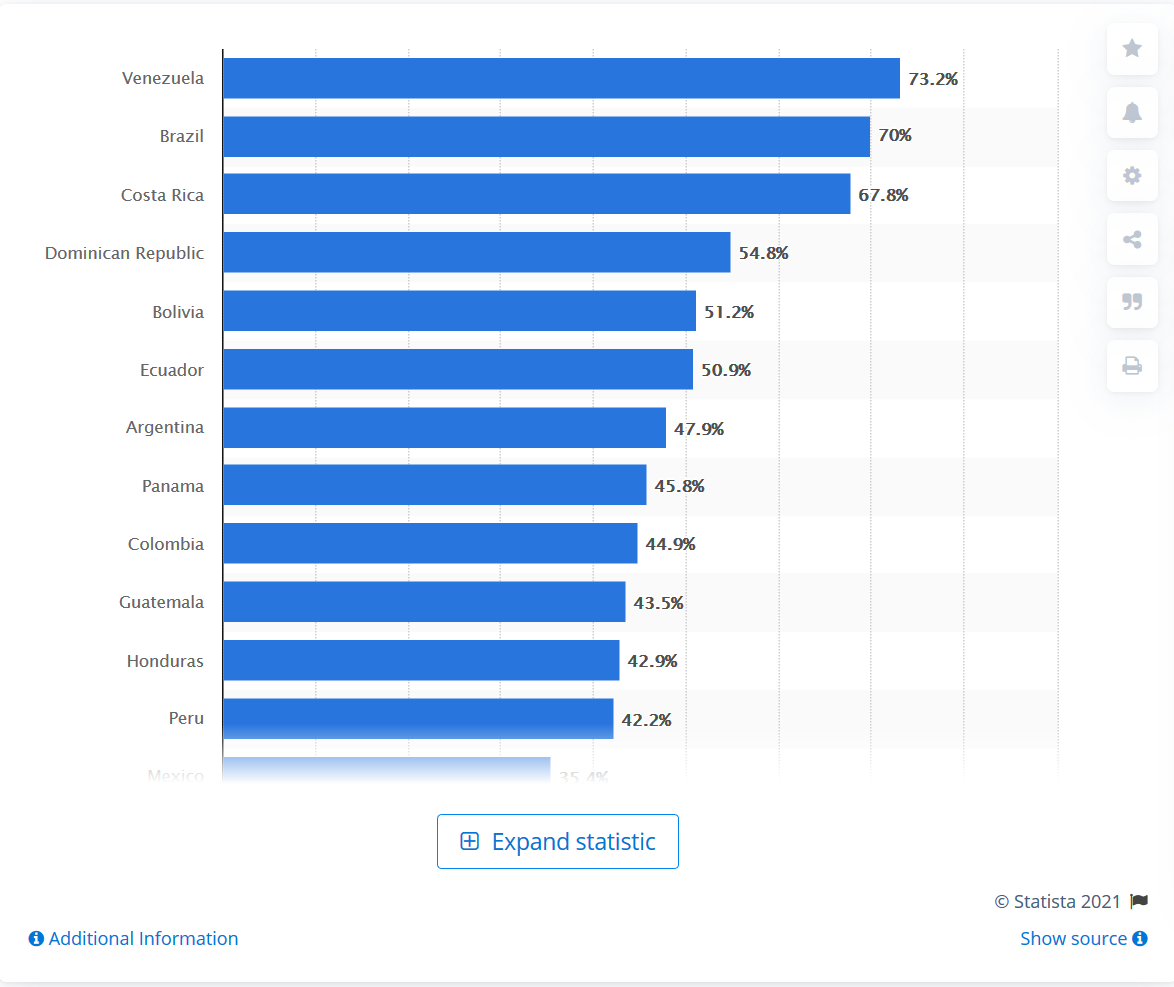

As mentioned, a large portion of Latin Americans do not have bank accounts. Brazil and Venezuela have the largest percentage of people with bank accounts.

Digital Wallets

Digital wallets accounted for about one-quarter of Mexican e-commerce purchases in 2020. The adoption of digital wallets makes sense among Latin America, where 85% of transactions are cash based and only 39% of the population has a bank account.

Moreover, it’s been incredibly difficult for credit card lenders to penetrate the Latin American market. Many Latin Americans prefer to pay for e-commerce items in installments. For example, almost 80% of Brazilian e-commerce purchases leverage installments.

Moreover, the adoption of mobile fuels the use of digital wallets in LatAm. Smartphones accounted for 69% of all mobile connections in Latin America in 2019, and the share is expected to increase to 80% by 2025. Paypal has seen strong growth in the region, enabling global commerce. But, many digital wallets are connected to regional brands, such as OXXO in Mexico.

Digital Payments and Electronic Invoicing

Riding the fintech boom, Latin America will experience a growth in e-invoicing. Chile, implementing mandatory e-invoicing in 2003, has a 97% adoption rate. Mexico and Brazil have over 90% adoption rates as well.

Fintech and Crypto Regulation in Latin America

El Salvador is the first in the world to adopt Bitcoin as legal currency. The country’s congress voted hugely in favor. Money sent from elsewhere made up 20% of El Salvador’s GDP (2019).

But, a huge chunk of the funds are lost through intermediary parties that charge large fees. 70% of El Salvador’s population rely on remittance services, for many natives do not have bank accounts or credit cards.

Skeptics call Bitcoin volatile and adopters believe victory is imminent. Bitcoin has seen positive movement throughout the last year.

Read more about Cryptocurrency in Latin America

Latin America is undergoing widespread testing of fintech innovations and the impact on existing and ongoing banking regulations. “Sandboxes” allow companies to test services on a small population for a short amount of time to facilitate troubleshooting, optimize integration, and improve customer experience.

Mexico was among the first to regulate fintech. There is a two-year test period. Then, brands may ask for a year extension. However, skeptics wonder if startups will struggle beyond the two-year period, when fintech companies must adhere to strict government regulations. Three years since Mexico’s Fintech Law was approved, six startups have been asked to participate in the sandbox.

Brazil has three sandboxes divided by industry. However, processes can be murky due to the involvement of multiple regulators. The lack of clarity, along with the possibility that regulations may ultimately stymie innovation rather than support it, makes Brazil contrast from Chile, a region free of sandboxes.

Conclusion

Latin America offers many fintech investment prospects and continues to attract VC money. And, unlike the United States, there’s room for companies to grow without interference from sectors too crowded with competition.

There is a great opportunity for brands that want to attract Hispanic consumers throughout Latin America, whether that means establishing satellite locations in LatAm or creating a partnership with Spanish marketing professionals.

But, localization serves as a huge barrier to American brands that are inexperienced in using native language and understanding regional buying behaviors. So, while many US-based brands seek translation services, successful penetration of Hispanic markets necessitates much more.

Let’s discuss entering Latin American markets or how Altura can help you attract Hispanic customers in the United States. We specialize in developing and executing world-class Spanish SEO, PPC, social media, and content marketing campaigns. Our unparalleled process enables our clients to understand LatAm regions and individual markets for an optimal ROI and impact upon Hispanic consumers worldwide.

Sources:

https://news.crunchbase.com/news/fintech-success-in-latin-america-opens-doors-for-us-venture-funds/

https://pitchbook.com/news/articles/vc-latin-america-swells-fintech-takes-flight

https://www.digipay.guru/blog/fintech-boom-in-latin-america-stats-trends-future

https://www.entrepreneur.com/article/374788

https://www.visualcapitalist.com/banking-unbanked-emerging-markets/

https://www.statista.com/statistics/1233960/latin-america-payment-platform-visits/

https://techcrunch.com/2021/06/08/fintech-all-star-nubank-raises-a-750m-mega-round/

https://www.statista.com/statistics/218531/latin-american-smartphone-penetration-since-2008/