Marketing in Latin America Since Covid

Marketing in Latin America Since Covid

More American and global brands take interest in marketing in Latin America. While 20/20 designates perfect vision, no one saw 2020 coming. Covid-19 impacts consumer behavior across LATAM, making it more important for interested parties to trace how the pandemic influences consumer decisions and overall sales.

Latin America’s first confirmed case of Covid came in late February. By a July survey, LATAM had become the region with the highest number of confirmed cases in the world, accounting for more than one-quarter of global cases.

While online trends grow in LATAM, Covid makes online shopping and social media use a steady reality. Below, gain a better perspective of consumer behavior in particular areas throughout LATAM and how brands may capitalize on growing e-commerce and social media opportunities.

A Closer View of Covid in LATAM

At the beginning of the Covid pandemic, LATAM consumers began changing behavior. In early April, e-commerce revenue in Peru increased by 900%. Throughout Latin America, the e-commerce growth rate surpassed 220%.

LATAM online marketplace, Mercado Libre, saw a 125% increase in online orders in Chile alone once the pandemic hit, with Colombia seeing a 119% increase, and Mexico growing its online orders by 112%.

Marketing in Latin America – Brazil

Brazil, most influenced by the virus outbreak, reports more than 6.5 million cases (as of December). Argentina, with the second-most number of cases, reports 1.4 million.

An April survey found 34% respondents admitting to increasing delivery services throughout Brazil. 28% admitted to making more online purchases, and 35% vowed to use delivery services more often.

47% increased food spending during Covid-19, and more Brazilians reported a trend of spending more on cleaning and health products and less on non-essentials such as sporting goods, stationary, and beauty products.

Marketing in Latin America – Mexico

One-third of those surveyed in Mexico stated they would decrease spending back in the early days of Covid. From April to June, 64% of those surveyed stated they would be buying food online.

While Mexicans initially attempted to conserve money at the onset of the outbreak, items categorized as entertainment/technology and long-term care (fashion and personal care) became increasingly sought.

Mobile traffic to online giant WalMart saw a rise of 63%, and Mercado Libre saw a mobile traffic increase of 16%. 80% of those in Mexico reported a higher usage of social media platform, Facebook.

Further Reading:

Social Media Marketing in Latin America

LATAM’s fervor for social media is unmatched around the world. Latin American users spend almost twice as much time using social media than those in North America.

Moreover, Latin American buying behavior is heavily influenced by social media. Over two-thirds of the population consult social media to glean news, feedback, and reviews.

In 2019, four out of five Latin Americans had at least one social media profile, accounting for more than 370 million mobile users.

Even older generations maintain accounts on social media sites and mobile app platforms; Baby Boomers were estimated to have an average of more than seven social accounts across various platforms.

Even before Covid, the use of social media was on the rise. In Mexico, 96% of people aged 20 to 30 admitted to using at least one social media platform. Users were spending an average of 3.5 hours daily on social platforms.

Mexico hosts Facebook’s fifth-largest global market. Based on latest updates, Mexico’s most-popular social networks are Facebook, Pinterest, and Twitter, followed by YouTube and Instagram.

Facebook in Latin America

Since April, LATAM has seen an increase in Facebook users. Brazil hosts 140 million users, Mexico has 92 million, and Colombia has 35 million active users. The trend is expected to continue.

In March, Brazilian Facebook users created 37% more posts as compared to the same month of the prior year. Likewise, LATAM governments took to Facebook to communicate Covid-related news. Governmental participation in the social media platform increased by 36%.

This shows countries in LATAM with the most Facebook users as of April 2020.

Further Reading:

Latin America’s Divided Attention

We study the past to better understand the future. Therefore, it’s useful for marketers to gain a sense of consumer behavior before Covid. In 2018, TV was the preferred advertising medium throughout LATAM. Two-thirds of all ad money spent in the region was associated with television advertising.

However, it was found that 80% of Latin Americans were not paying attention to ads on the television during commercial breaks. According to the 2018 study, 45% of LATAM natives were not even looking at their television when it was on.

So where is their attention? The attention was diverted to mobile devices for several reasons:

- To text friends/family

- To access social networks

- Multitasking (shopping, reading online reviews)

- Not engaged by what’s on television

- Wanted to discuss what’s on TV via social platforms/apps

Looking more in-depth, research found ways to re-engage Latin American attention by combining TV ads with social media (mostly Facebook).

Cross-Platform Marketing in LATAM

Savvy advertisers use cross-platform endeavors to captivate Latin American consumers. One particular study measured performance when Facebook ads were layered-in with television advertising.

In Mexico, Facebook provided an average of 17% added reach. Brands reached an additional 2.5 million consumers compared to those leveraging television alone. Campaigns that utilized TV, Facebook, and Instagram had a sales outcome 1.3 greater than expected.

This impact was more prevalent with younger consumers. One Coke campaign, targeting consumers aged 18-34, had a total reach of 77% on Facebook compared to a total of 53% on TV.

Nielsen compared TV and Facebook impressions to test how effective each medium was in finding the right audience to each campaign.

In Brazil, Facebook received an average of 94% on-target impressions compared to TV’s 60%. In Mexico, Facebook was twice as precise. 91% of Facebook ads were delivered on-target compared to TV’s 44%.

Further Reading:

Marketing in Latin America After Covid

Grabbing LATAM attention amid Covid calls for tracking past trends and aligning them with present conditions and consumer behavior. At this point, marketers recognize:

- LATAM consumers spend more time at home

- A growing trend in e-commerce and social media use

- Cross-platform marketing is effective when combined with regional research

Consider the following marketing insights for marketing in Latin America since Covid.

Get Hyper Local

The nature of a consumer of the same age, sex, and interest may be vastly different depending on location. A similar “target” who lives in Mexico has a different set of values, online intent, and verbiage than a similar consumer in Brazil.

Both consumers may speak Spanish as their primary language. However, a person living in London and another in Alaska also share the same language, yet marketers are aware that may be all they share.

Therefore, the notion of “marketing in Spanish” makes as much sense as the notion of expecting the same behavior from all English speakers across the globe (despite geographic location).

The Spanish Language is Segmented

People of LATAM use different versions of the same language, accounting for formal and informal speech and text. Therefore, a person who searches for a particular product/service in Peru may use entirely different keywords than those seeking the same in Colombia.

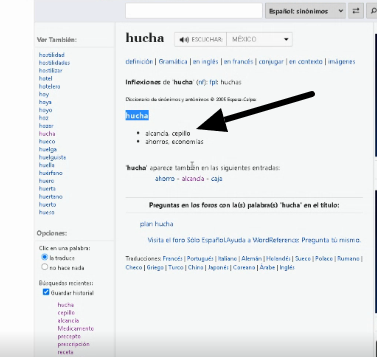

For example, Google translates the word “piggy bank” to the Spanish, “hucha.” So, a person doing keyword research may seek synonyms for the word.

“Cepillo” is identified as a synonym for “hucha.” However, cepillo is not used to signify piggy banks. Most align the word, cepillo with some sort of brush.

Furthermore, going back to the initial translation of piggy bank to hucha, it’s necessary to investigate whether using “hucha” is better aligned in particular Spanish-speaking countries and regions.

Notice how use of the term varies throughout subregions of Mexico.

If you readily accepted that term to target potential buyers throughout Latin America, you’re making a mistake, for that particular word/product is best aligned for consumers in Spain. If you tried to sell piggy banks in Mexico using the word “hucha,” you would not be nearly as effective.

Translation is Not Good Enough

Many American and global brands seek Spanish translation services in an attempt to market throughout Spanish-speaking countries, a fundamental error. Marketing in Latin America requires transcreation service providers, those who understand nuances of the language and how different regions leverage the Spanish language.

What brands need to successfully penetrate LATAM markets is more like a liaison, a service that can effectively relate brand messages to consumers throughout individual Latin American countries.

Altura wants to help you succeed in Latin America by making authentic connections via social media. We can help you make the most of social media platforms, so brand messages accurately reflect intention without getting lost in translation.