Cryptocurrency in Latin America

Cryptocurrency in Latin America

Cryptocurrency in Latin America is going to be a recurring news topic. El Salvador made news this week, becoming the first country in the world to make Bitcoin legal tender.

The country’s congress voted hugely in favor. Money sent there from elsewhere accounted for 20% of El Salvador’s GDP (2019). But, a huge chunk is lost through intermediary parties that enable the remittances yet charge large fees.

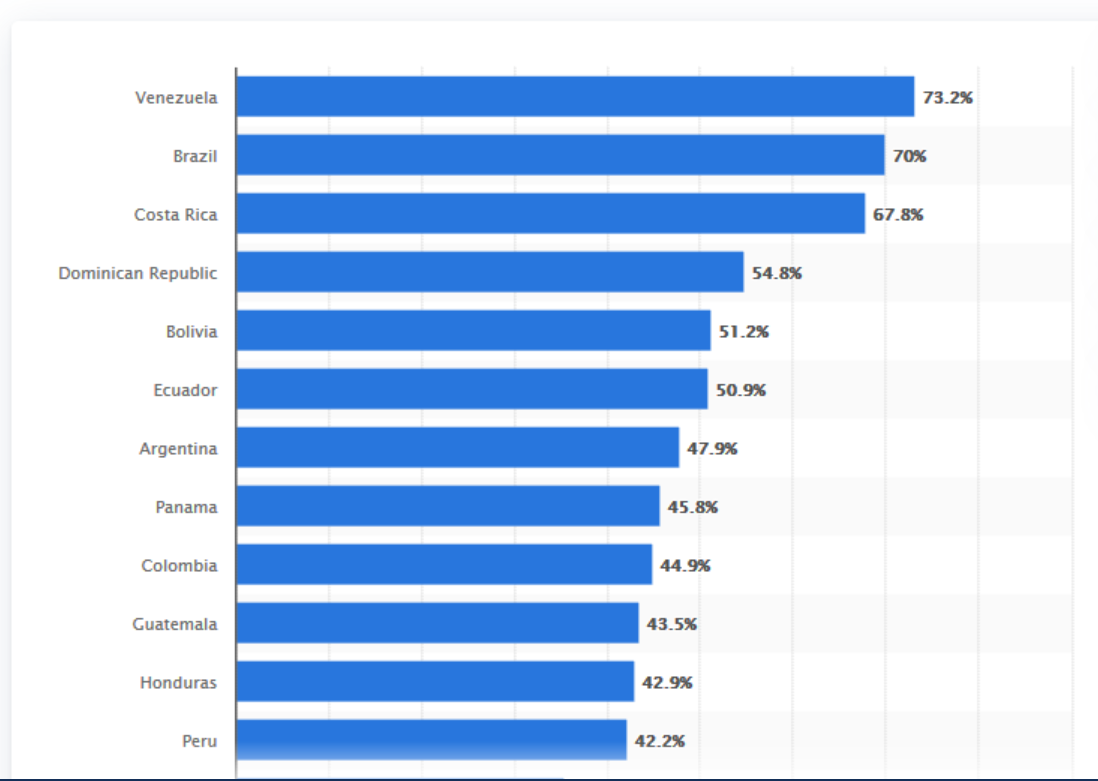

70% of El Salvador’s population relies on remittance services, for many natives do not have bank accounts or credit cards. A high percentage of Latin Americans do not have bank accounts.

To put it in better perspective, 73% of Venezuelans and 70% of Brazilians had bank accounts based on 2017 statistics. Those are the highest percentages throughout LatAm.

Fintech offers innovation within the financial sector and practical solutions for those in Latin America faced with large fees in sending and receiving funds.

Read more about Investing in Latin America

Bitso’s (Finally) Booming

Bitso is the crypto “papi” of the region. It’s among the largest fintechs and recently valued at $2.2 billion. But this was no flash in the pan, for it took Bitso six years to acquire its first million customers.

Then, it saw that number double in ten months. Now, it’s among the most valuable crypto platforms in LatAm. Surges in cryptocurrency use do not go unnoticed by investors. Bitso just raised $250 million from an impressive cast of investors including Kaszek and Tiger Global.

Bitso has taken root in Brazil and has its eyes on Colombia. Coincidentally, Colombian-born founder, David Velez, runs Nubank, a banking alternative and savior to those who do not have a bank account or credit card.

Nubank continues to flourish in Colombia and Mexico. Nubank was created to address a dire problem throughout LatAm – remittances.

Latin America and Remittances

Brazil had few banking options and super high fees. At a time, five banks accounted for over 80% of Brazil’s assets. One third of the population was unbanked. And, annual credit card rates were running up to 300%. Bank branches exist in just 60% of Brazilian cities.

Nubank seeks to solve such issues in Brazil and throughout Latin America. That startup states it has saved customers over $2 billion in fees. Nubank has a good thing going in Latin America, and considers going public on the NYSE.

“The crisis is forcing adoption in demographics that in normal times would have taken a long time to digitize. After the crisis passes, we’re only going to see even more acceleration of customers willing to use digital banking,” stated Nubank co-founder, Cristina Junqueira.

Smilarly, fintech startup, Uala, is doubling down on operations in Argentina and Mexico. Uala also wants to capitalize upon the lack of remittance and banking options.

Pierpaolo Barbieri, the Argentine company’s founder, voiced that “Latin America has a lot of potential to grow.” In less than 6 months after launch in Mexico, Uala issued over 100,000 debit cards throughout the country.

Moreover, Uala claims 2.5 million cardholders in Argentina. Following the virus outbreak, Argentina residents have been using all-digital platforms and services to take care of everyday needs – like paying bills.

Read more about Marketing in Latin America Since Covid

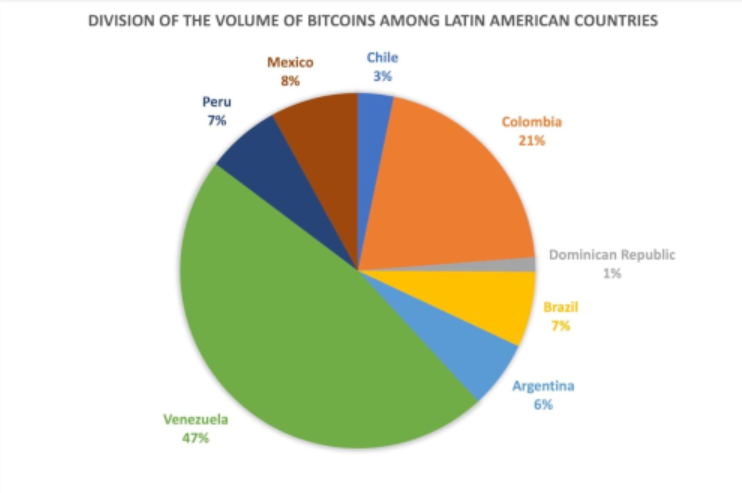

Latin American Countries Using Cryptocurrency

Mobile banking services in Mexico have been growing consistently since 2016. But, lately, cryptocurrency has become a logical part of Latin America’s banking evolution.

Latin American countries adopt respective positions on cryptocurrency. Bolivia prohibited cryptocurrency in 2014. However, Mexico, Argentina, Brazil, and others host an array of vendors who accept cryptocurrency as payment.

Cryptocurrency exchange regulations vary as much as the language across Latin America. Therefore, lack of regulations and high adoption rates make Latin America an attractive spot for those looking to invest in fintech and cryptocurrency.

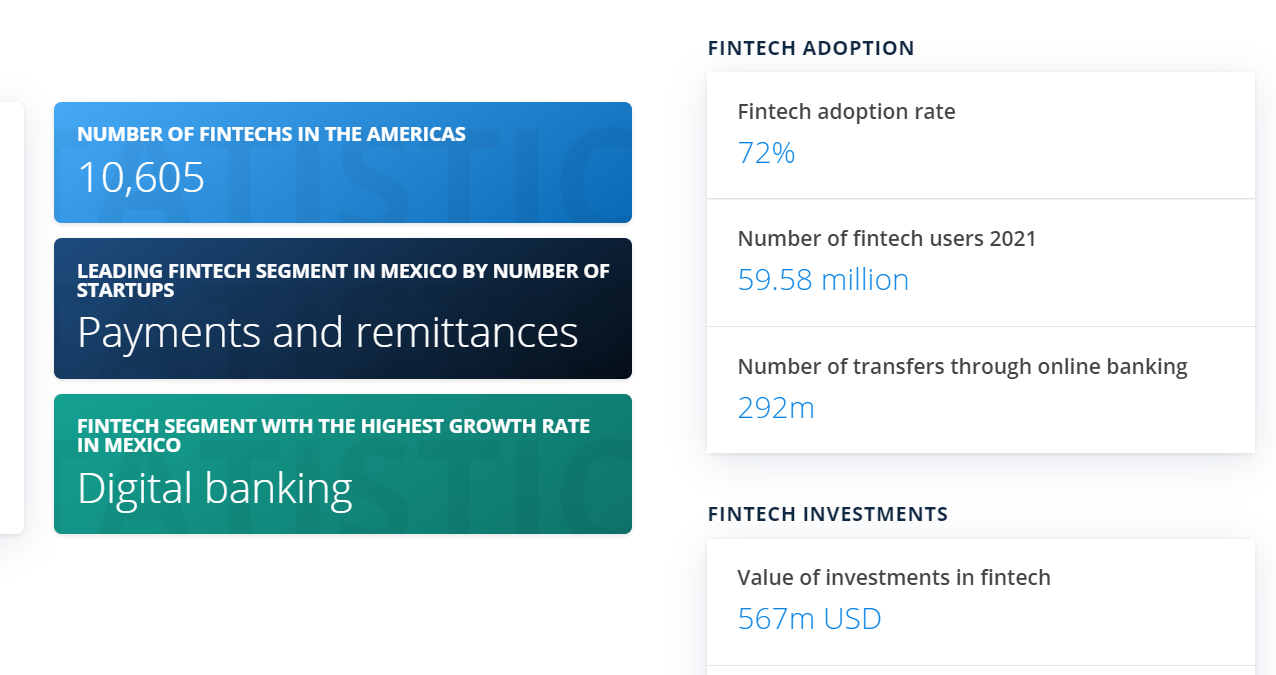

Based on 2020 stats, three out of 10 fintech startups (689) in Latin America reside in Brazil. Mexico is second with 486 companies.

Read more about Fintech in Mexico

Marketing in Latin America

Spanish SEO

Spanish is such a rich, diverse language, used respectively in countries throughout Latin America. Therefore, Spanish SEO is similar to general search engine optimization in that it aligns browsers with offered products and services.

However, Spanish SEO is unique in that it targets geographic regions and locales since the use of language differs across countries; Spanish is spoken differently in Mexico versus Colombia, and so on.

Spanish SEO is an incredible marketing tool when applied to Latin America. But, it’s also useful in targeting Hispanic consumers in North America.

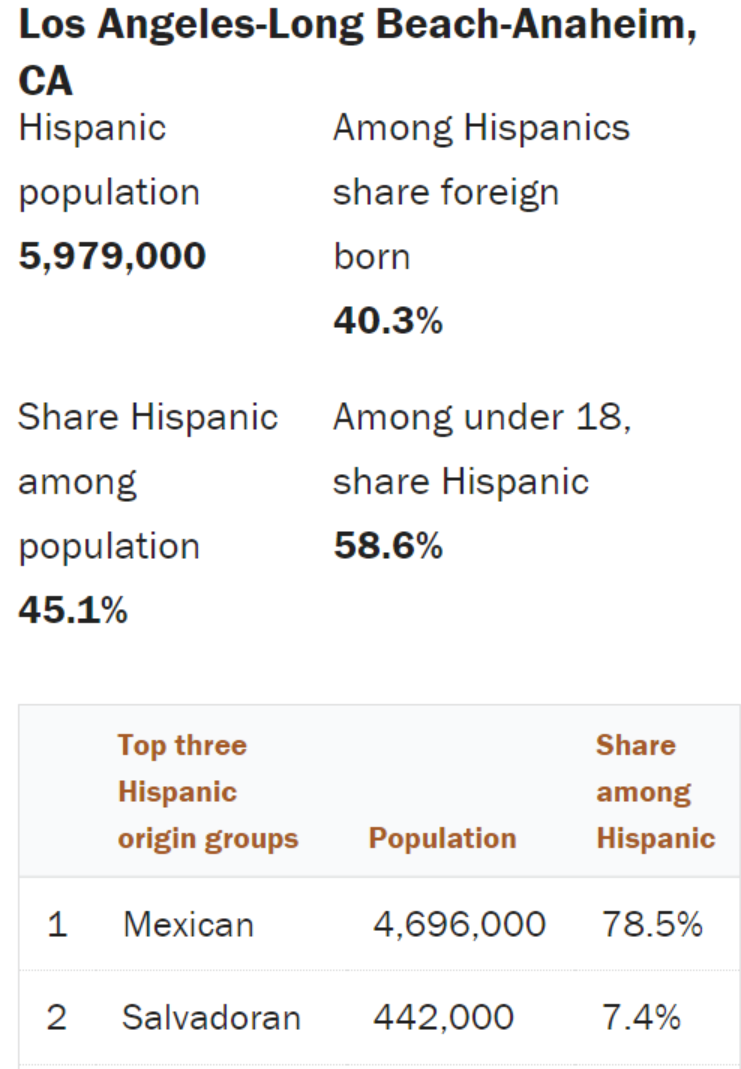

Spanish SEO experts analyze the Hispanic population of a specific area to understand the language usage and how consumers use search engines to seek information. Los Angeles, for example, has a large percentage of Hispanics with Mexican heritage.

This would differ from those living in Miami who speak Spanish used throughout Cuba and Colombia. Therefore, Spanish SEO agencies optimize website copy, ads, and other marketing materials to reflect the language and culture of a targeted population. It makes ads and messages more authentic and effective.

Spanish PPC

There are multiple ways to waste marketing dollars in operating an ineffective Spanish PPC campaign. Misunderstanding what kind of Spanish to use is one of them. Moreover, translating PPC keywords from English to Spanish creates additional errors and mistakes.

Consider another layer of Spanish PPC; a user may search for a product or service in English or Spanish. So, PPC experts refine strategies and create hyper targeted ads to ensure a good ROI.

Read more about Spanish PPC

Spanish Translation

The history of marketing is filled with mishaps, ranging from humorous to humiliating, that involve English-to-Spanish translation errors. For example, one infamous airline wanted to promote its plush leather seating yet mistakenly asked its consumers to “fly naked” instead.

Additionally, translation errors can alienate Hispanic consumers from the very brands that seek to attract them. The best Spanish marketing campaigns feature optimized language and cultural references.

Read more about Top Hispanic Marketing Campaigns

Contact Altura Interactive about starting a Spanish SEO campaign. We specialize in targeting specific Hispanic markets within the US and across Latin America.