Last-Mile Delivery Finds Latin America

During the pandemic, more people grew accustomed to ordering goods from the Web. 45% of US residents are Amazon Prime members. Consumers are cool with ordering coveted goods from the Web yet get hot headed if it takes too long. Burger King managed to leverage Mexican traffic, serving up a creative and successful delivery campaign.

Further Reading:

Best Hispanic Marketing Campaigns

Last-Mile Delivery in Latin America

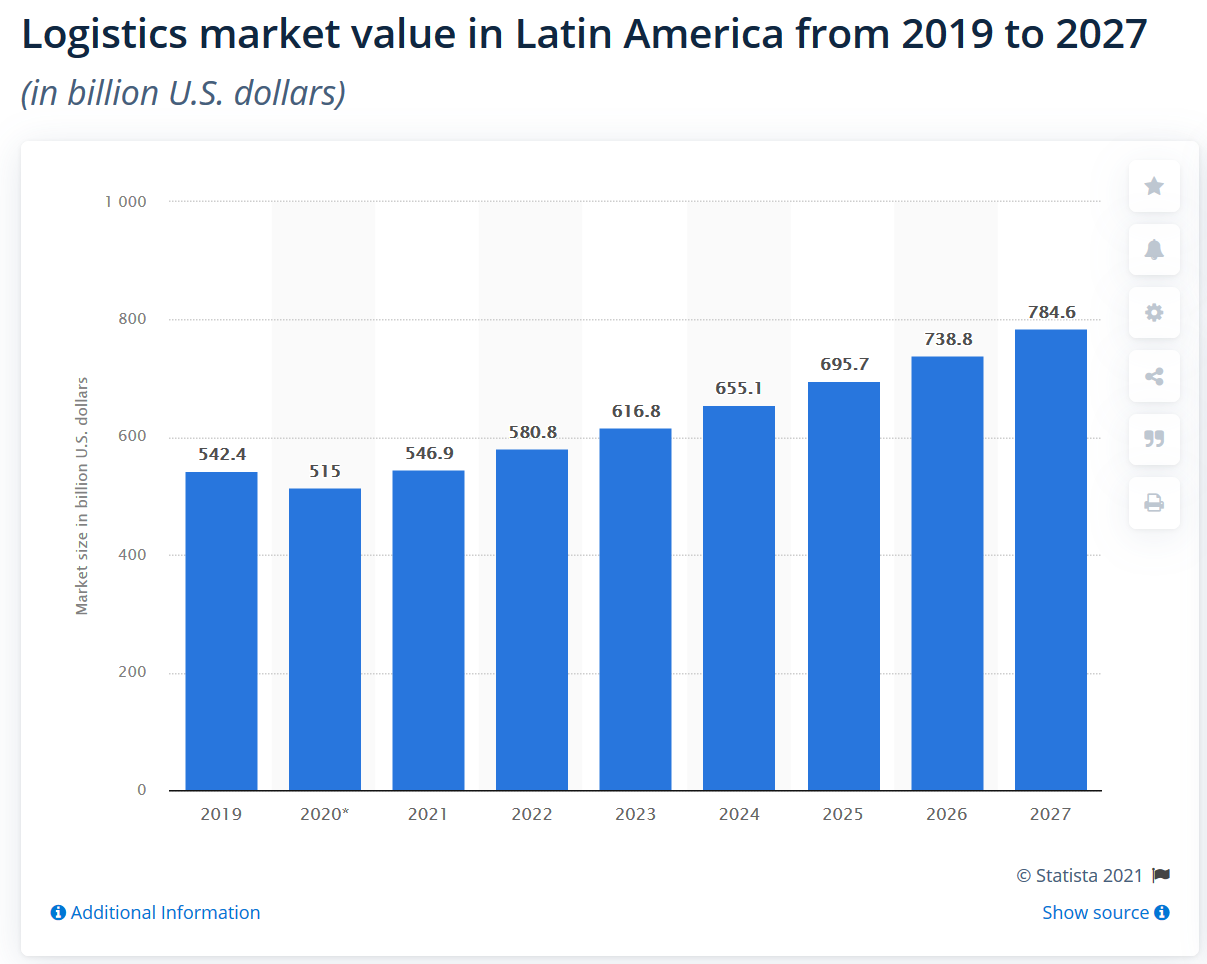

Latin America largely lags when it comes to last-mile delivery. Globally speaking, last-mile logistics is a significant investment ($11 billion in the last decade). Yet, Latin America invested just $1 billion in the last ten years.

Some consumers covet nostalgia. Others prefer high quality. When it comes to e-commerce, consumers want speedy delivery. Actually, e-commerce’s race against time is similar to that of last-mile delivery services.

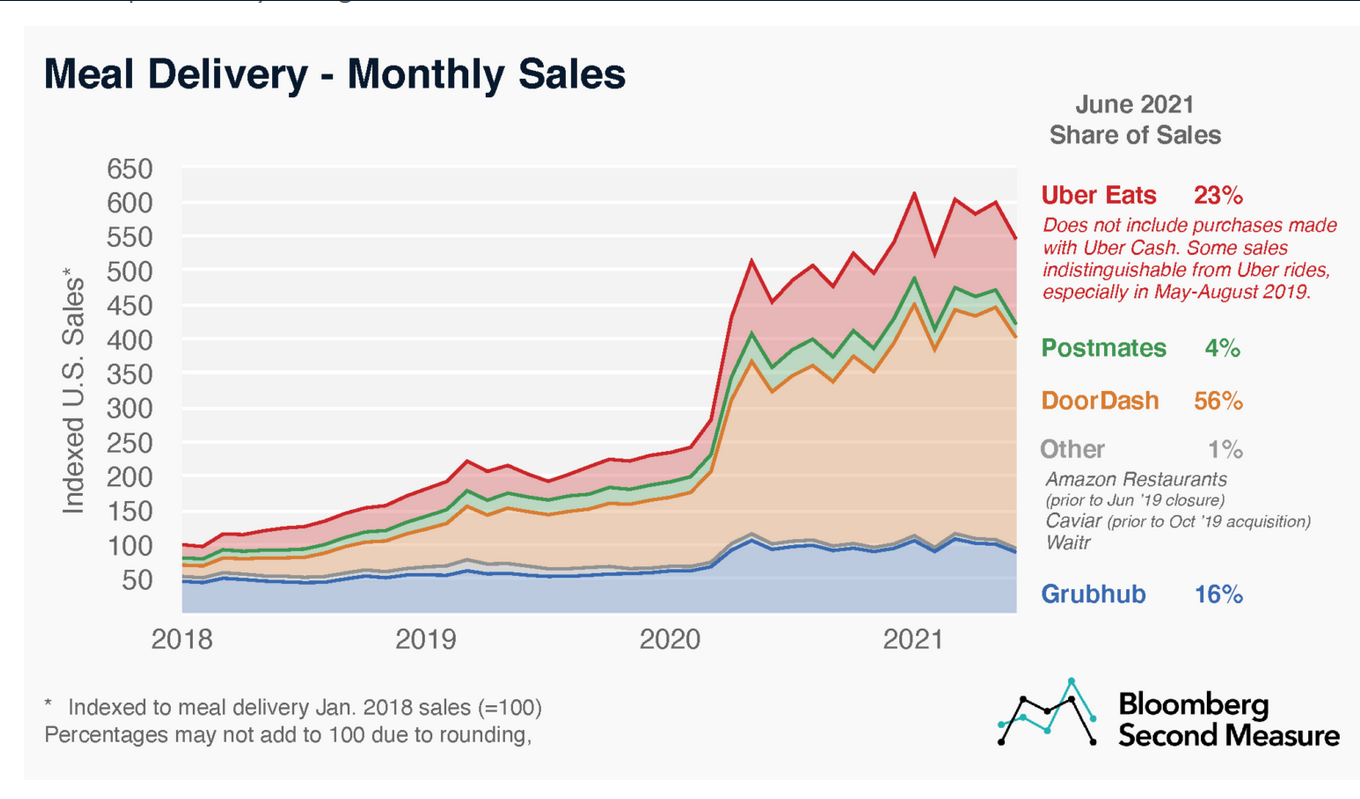

Meal delivery services continue to figure the best way to cater to a growing number of consumers that want food faster. 2018-2021 sales data reflects that US residents quickly grew accustomed to meal delivery, so Latin American startups hope to do the same before competitors expand into LatAm territory.

Last-mile delivery is an angle grocers and restaurants around the world rely upon. And, some delivery services have gained enough local traction to allow for global expansion. Turkish brand, Getir (Turkish for “bring”) plans to expand throughout Europe. Getir promises to serve up desired goods in 10 minutes.

Food delivery is a growing sector that tantalizes the appetite of investors. Glovo, founded in Barcelona, raised $ 500 million this April. And, Philadelphia-based, Gopuff recently raised $1.5 billion.

Latin America’s limited investment in last-mile logistics perplexes me along with something else; most of it is rooted in Brazil, a Portuguese-speaking country. Loggi (based in Brazil) accounts for 60% of last-mile VC investment in Latin America. Yet, Loggi only operates in Brazil.

So, Spanish-speaking countries in Latin America offer opportunity! Limited technology and bumps in supply chains impede current service providers. 60% of the region’s last-mile providers is comprised of small businesses and independent drivers.

Further Reading:

Last-Mile Delivery in Mexico

Online sales grew dramatically in Mexico during the pandemic. So, a number of last-mile delivery methods and service providers rose to the occasion. The online sales of foods and beverages equaled $654 million in 2020. That’s projected to exceed $900 million by 2025.

Cargamos uses ‘dark stores,’ structures used for storage alone that remain closed to the public. Cornerbox was conceptualized in Chile and expanded throughout Latin America; its Mexican consumers have supermarket goods delivered as well as those from pet supplies, electronic stores, etc.

Dostavista promises to deliver goods in less than 60 minutes. Dostavista’s growth reached impressive heights in Mexico City, increasing over 300% during low-peak hours and 450% during high-peak periods.

Rappi offers an assortment of 1,000 products and will get them, along with food from restaurants and supermarkets, to your door in 10 minutes.

Urban Messengers adds a touch of urban style. It maneuvers through the congested streets of Mexico City as it does in Bogota. An army of motorcycled couriers weave through mazes of traffic and finish with terrific delivery times.

Mexico Is Becoming a Latin King

There’s reason for last-mile delivery brands to take root within or expand into Mexico. Next to Brazil, Mexico has the leading e-commerce market. But, experts believe Mexico may take first place soon; 2025 projections set Mexico’s e-commerce sales ($53 billion) higher than Brazil’s ($50 billion).

Mexican online grocer, Justo raised $65 million in funding in February. The company, founded in 2019, seeks to interrupt the Mexican grocery space, being the first Mexican grocer without a physical store.

The startup only sells products from local suppliers and uses artificial intelligence to minimize food waste. The company has close to 500 employees (40% of which are female).

Further reading:

Marketing in Latin America Since Covid

Startups in Latin America

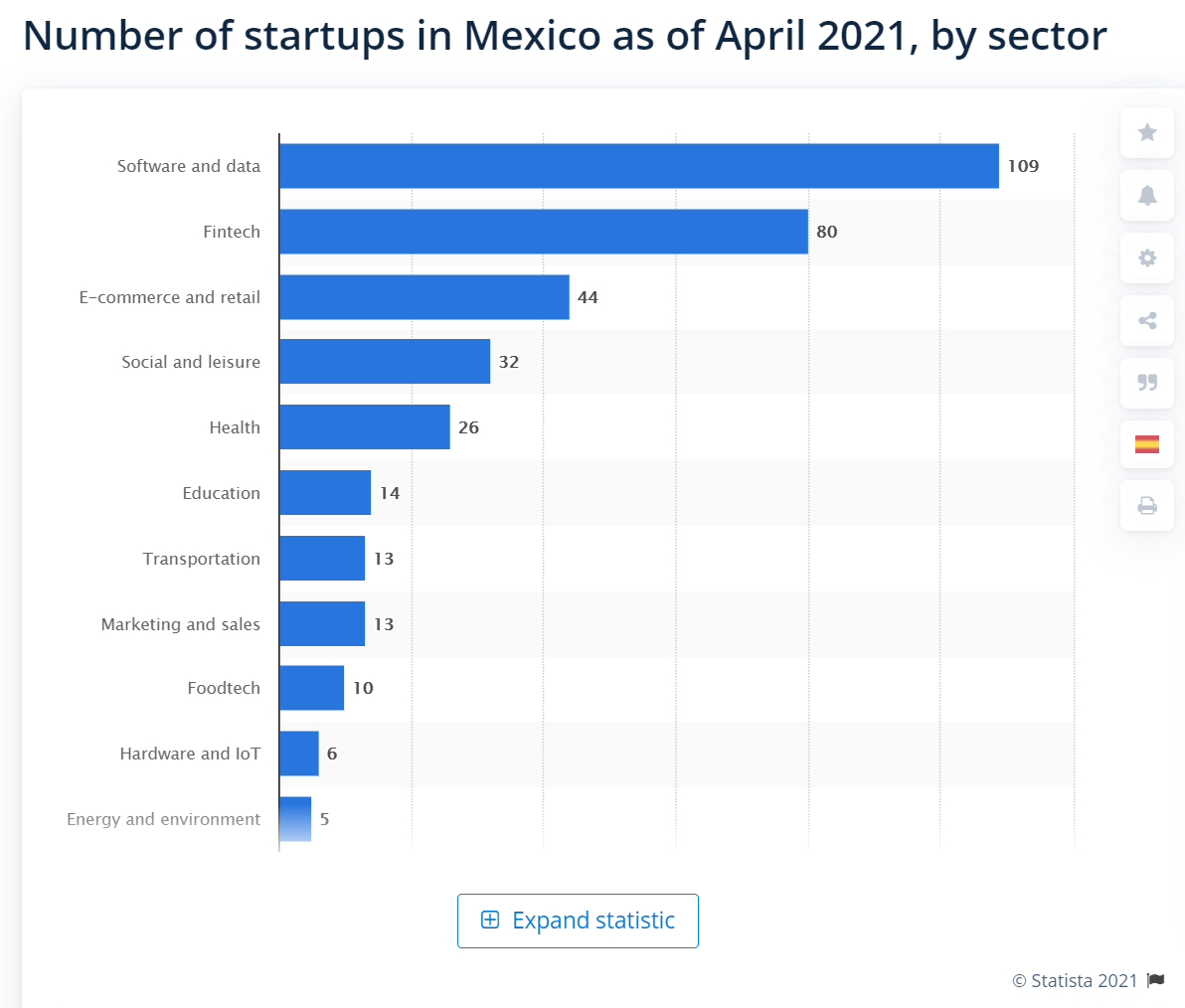

Justo has attracted over $100 million in investor funds. Latin American unicorns are now a reality but it wasn’t always that way. VC investment in the region has grown 30x since 2011. 2020 investment in Latin American startups amounted to more than $4 billion.

Interestingly, Mexican startup, Kavak may help fuel last-mile delivery endeavors. It started as a humble operation but now boasts it will sell 50,000 pre-owned vehicles by the end of 2022. Leveraging technology and physical hubs, the brand buys, refurbishes, and sells cars online or at physical locations.

Thanks to a new range of financial options, Latin Americans can access credit and loans more easily. Kavak raised its valuation to $4 billion as investors, such as SoftBank Group Corp, recently devoting another $5 billion toward Latin America, seek to create more unicorns.

Further Reading:

Actually, Latin America is on pace to set all-time records for VC investment and rounds of funding in 2021. Startups in the region have raised $9.3 billion so far in 2021, accounting for 414 deals. To compare, 520 deals in all of 2020 accounted for $5.3 billion.

$7.2 billion dollars were devoted toward Latin American startups in Q2 of 2021. That’s bonkers!

Further Reading:

Should I Invest in Latin America

Altura serves as your guide throughout Latin America. Allow us to introduce your brand to new consumers in LatAm’s many countries. Also, we cater to service providers who seek to make a better impact on Hispanic markets in the United States. Let’s start talking about growing your business.

sources:

https:// techcrunch.com/2021/07/22/last-mile-delivery-in-latin-america-is-ready-to-take-off/

https://www.entrepreneur.com/article/378515

https: //techcrunch.com/2021/02/09/mexican-online-grocer-justo-raises-65m-in-general-atlantic-led-series-a/

https://www.statista.com/forecasts/1230793/food-beverage-ecommerce-revenue-mexico

https://www.statista.com/statistics/804022/latin-america-e-commerce-sales/

https://www.statista.com/statistics/877609/mexico-sector-startups/

https: //techcrunch.com/2021/07/29/why-latin-american-venture-capital-is-breaking-records-this-year/

https://www.statista.com/statistics/1237733/logistics-market-value-latin-america/