Fintech in Mexico

Only China and India surpass Mexico when it comes to the number of remittances. A remittance is a transfer of money.

Remittances are among Mexico’s top sources of foreign exchange. Since Covid, the inflow of remittance-based foreign currency has grown 10% in a year.

And, financial technology solutions present alternatives in sending and receiving foreign currencies. Fintech companies offer incredible options for Mexicans when it comes to remittance.

Once a pain point for those wanting to send and receive money from Mexico, fintech brands provide convenience for shoppers, vendors, and entrepreneurs.

Fintech’s Influence on Mexico’s Remittance

A great percentage of Mexicans do not have traditional bank accounts. Therefore, the accessibility to financial tools that readily allow consumers to send, receive, and transfer money is … priceless.

Consider reasons for fintech’s popularity in Mexico and throughout LATAM.

No Need for Bank Accounts

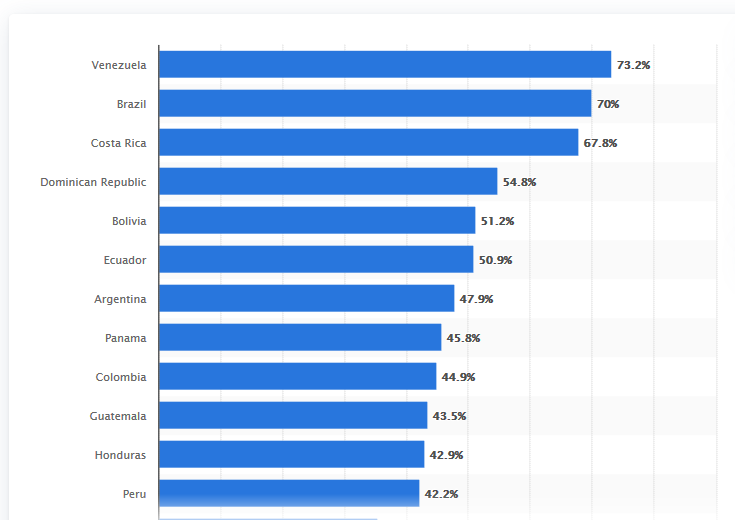

A great percentage of Latin Americans do not have bank accounts. 2017 data shows the percentage of those with bank accounts in respective LATAM countries.

Based on 2017 stats, 35% of Mexicans had an account at a bank or other financial institution. That number declined from 39% (2014).

Albo is one Mexican fintech brand looking to make banking easier for LATAM businesses. Consumers can open an account, place money toward an international credit card, and then spend, send, and receive currency.

The Transfer is Faster

It can take up to four days when sending cash to Mexico via bank account transfer. However, transfers can take seconds when using financial technology apps. Xoom is a PayPal service extension that allows for remittance to Mexico and 131 countries.

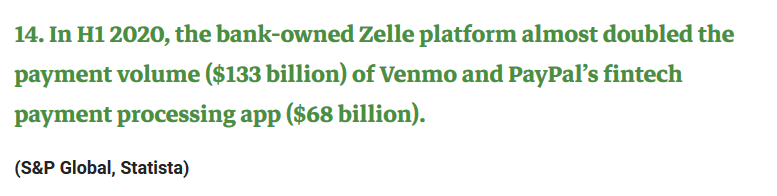

Interestingly, Zelle, enabling peer-to-peer transfer of funds via linked bank accounts, has increased in popularity due to its convenient and instant process.

Those using such services can see their transfer in minutes. Xoom allows for transfer to Mexican banks or one of 35,000 associated cash-pick-up sites.

FinTech is Growing in Mexico

2019’s adoption rate of fintech is measured at 64% globally. That’s up from 16% in 2015. Based on 2019 statistics, Mexico had the most fintech startups, followed by Brazil.

Payment and remittances comprise about 20% of the fintech startups in Mexico based on 2020 data.

Mexican Businesses, Covid, and Remittance

Covid has financially deflated economies around the world, including those within LATAM. In some ways, lack of work or income has encouraged Mexican entrepreneurs and startup ventures.

Fintech brands, offering remittance services, provide hope and options to burgeoning and existing Mexican SMBs.

Kueski Gives Entrepreneurs Hope

Since Covid, Kueski continues to give Mexican entrepreneurs the ability to attain a personal loan. The website attests to providing over 3 million loans to Latin Americans.

Mexican SMBs Seek Loans

Credijusto raised money in the first quarter of 2020, enabling Mexican SMBs access to more loans. This is a huge relief for Mexican SMBs that find it challenging to secure funds from Mexican banks during the pandemic.

Another Mexican fintech brand, Kubo Financiero, provided 12,000 loans in 2019 (a 33% increase from the prior year). The revenue generated from interest was reported at 174 million pesos.

Read more about Marketing in Latin America and Covid

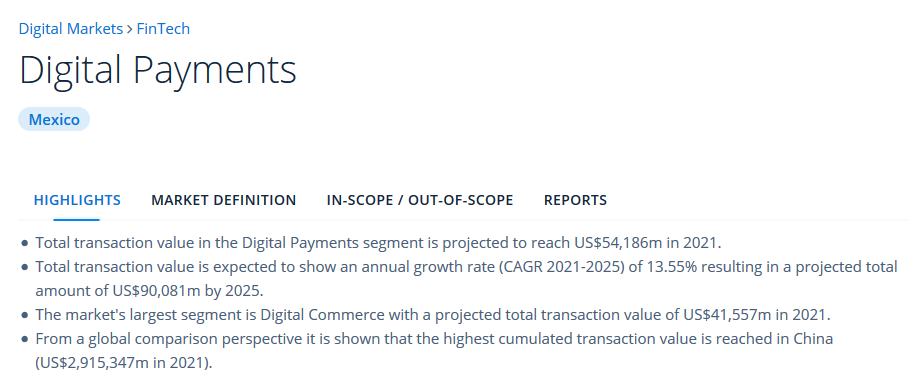

Mexico and Digital Payments

Consumers across the globe embrace digital payment methods, and Mexico is no exception.

Western culture is rooted in cashless credit while emerging economies seem to embrace mobile wallets, which are reliant on cash-based accessibility. The dynamic is incredibly important for Mexican brands, especially those that are web-based.

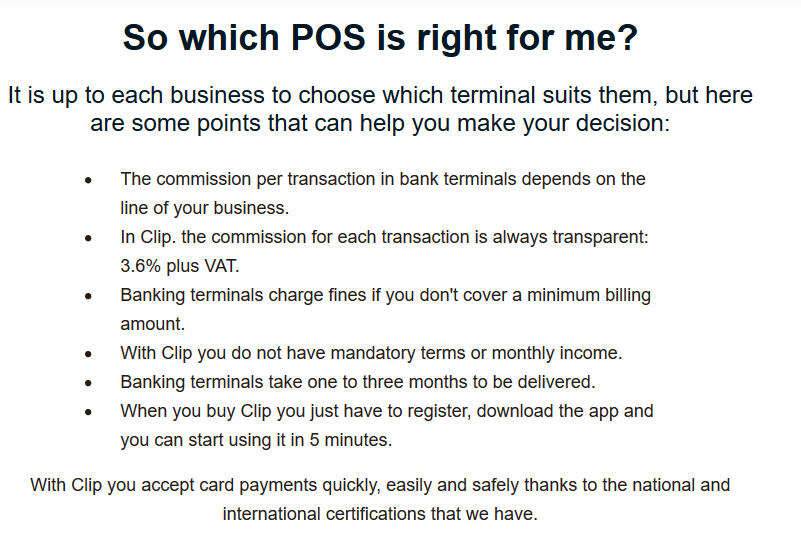

Cash is the most-common method of payment within Mexico. So, online vendors embrace tools like Clip, enabling SMBs to accept digital payments. Consider the advantage the fintech provides over choosing another POS provider:

When vetting Mexican fintechs, mention of Samsung Pay is commonplace. As of mid 2019, 6.8% of Mexican mobile devices had the Samsung Pay app installed. That is considerable as compared to Paypal and MercadoLibre (both lower than 2%).

Exchange Issues Solved

At Altura, we specialize in remedying translation issues. Similarly, currency exchange is a huge problem with many online platforms. Mexican fintech, Conekta, addresses such issues by allowing for exchange agility. Developers and companies can create payment solutions for any website and accommodate any app.

Note that OXXO is a part of the fintech’s benefits. That is because the convenience store is heavily ingrained in Mexican culture.

Read more about marketing SaaS brands.

Would you like to solve any potential ‘foreign exchange’ issues related to your brand’s content marketing or SEO? We’re experienced marketers. Even better, we’re living the life in Latin America and can help you speak the language of ready and willing consumers across LATAM.